Woodhurst’s series ‘Harnessing AI in Financial Services’ delves into the key enablers for financial services to effectively adopt AI, covering data readiness, governance, workforce collaboration, and scaling AI across the enterprise. After covering the high-level approach to AI in our first article, this second instalment will dive into data.

Regardless of how sophisticated AI tools become, their value hinges entirely on the quality and structure of the data underpinning them, which means it’s critical to ensure your data is high quality, well-governed, and easily accessible.

In this article, we’ll explore:

- What it means for data to be ‘ready’ for AI

- Common data maturity challenges financial services organisations face

- How to establish the governance and literacy needed to support responsible, scalable AI adoption

- Developing your use-cases, and finally

- A roadmap to AI-ready data.

Our coverage of these issues has been bolstered by conversations with Graham Coe, the IT Director at Shire Leasing. Graham provided insights on the real challenges being faced within the industry on this topic, and why now is a pivotal moment for financial services to explore AI; not as a future ambition, but as a strategic response to operational complexity and shifting customer expectations.

What Makes Your Data “AI-Ready”?

As AI is becoming more entrenched in day-to-day operations, the volume of AI-generated content online is increasing, such that it is now being used implicitly to train new models. If the outputs from the former models are lacking in quality, this detriment is multiplied exponentially for the latter models [1].

Before AI models can deliver meaningful insights, automate decisions, or personalise experiences, organisations must first ensure their data is fit for purpose. But what does “AI-ready” data actually mean?

- High-Quality: Your data must be accurate, consistent, and up to date. Because AI models rely on clean data to detect patterns and make predictions, errors or inconsistencies are magnified downstream, making high quality data critical.

We have built a simplified case study to demonstrate the impact of low-quality data on AI’s ability to predict outcomes. Click here to walk through the case study.

- Accessible: Data should be centralised or easily retrievable across systems. If information is siloed across departments or buried in legacy platforms, the models will lack the holistic context needed to generate meaningful insights.

- Structured: AI performs best when data is well-organised and categorised. This allows better training of the model, and more reliable pattern detection. Defining the data model and supplying metadata supports provides extra context to the model, supporting better outputs.

- Secure and Compliant: Especially in financial services, ensuring data privacy, customer consent, and regulatory compliance is a non-negotiable and fundamental to building trust with customers. We will explore this in more detail later in the series.

A practical litmus test: If you cannot easily describe what data you have, where it lives, and who owns it, your data isn’t ready for AI.

Common Data Maturity Challenges in Financial Services

Many financial institutions face deep-rooted data challenges that must be addressed before AI can be deployed effectively. Overcoming these challenges starts with aligning your teams on the data strategy. Then, the investment in technology and the data-first culture follows naturally with purpose and clarity.

Challenge | Why It Matters |

Volume |

|

Data quality & Manual Data Processes |

|

Data Governance |

|

Siloed Systems |

|

Underinvestment in Data Infrastructure |

|

Building Strong Data Governance and Literacy

Laying the foundations for AI success means developing the right mindset and the right architecture. This starts with data governance and data literacy.

Data Governance

Good governance ensures that data is accurate, secure, and used appropriately across the organisation. Core components include:

- Defined ownership and stewardship, ensuring a company-wide approach to data management and stewardship.

- Data catalogues and dictionaries, that are maintained and updated as necessary.

- Access controls and user permissions, with a priority on privacy and robust controls.

- Clear governance policies for usage, retention, and quality assurance, in alignment with regulatory requirements and implemented with automation.

Establishing these practices instils confidence across the organisation that the data powering your business is reliable, accurate and compliant.

In November 2024, the Bank of England conducted a study on AI in UK financial services [2]. The chart below shows the percentage of firms with various data management policies, and highlights whether those policies are specific to AI or not. How does your organisation compare to these stats?

Data Literacy

As AI adoption grows, it’s essential that employees at all levels understand the value of data and how to use it responsibly. Building data literacy means:

- Helping teams interpret data correctly, and understand its source.

- Promoting responsible data handling, always protecting the customers’ privacy.

- Encouraging critical thinking around the outputs of AI tools.

With higher literacy, employees become better decision-makers, better collaborators with AI systems, and stronger defenders against potential misuse or misinterpretation.

Education around AI amongst employees is particularly important as the use of AI becomes more widespread. It’s likely your employees are using AI, even if your organisation does not have approved platforms or defined guardrails. Getting ahead with education, implementing governance policies and making the right data available is critical. This could start with:

- Run AI literacy sessions to ensure educated use of AI, with awareness of the risks and appropriate boundaries

- Create practical guidelines with relevant prompts, dos and don’ts, that are tailored to your teams

- Appoint AI champions across the business to embed best practice and field questions, to empower your people with the right skills

Start with the Foundations, Scale with Confidence

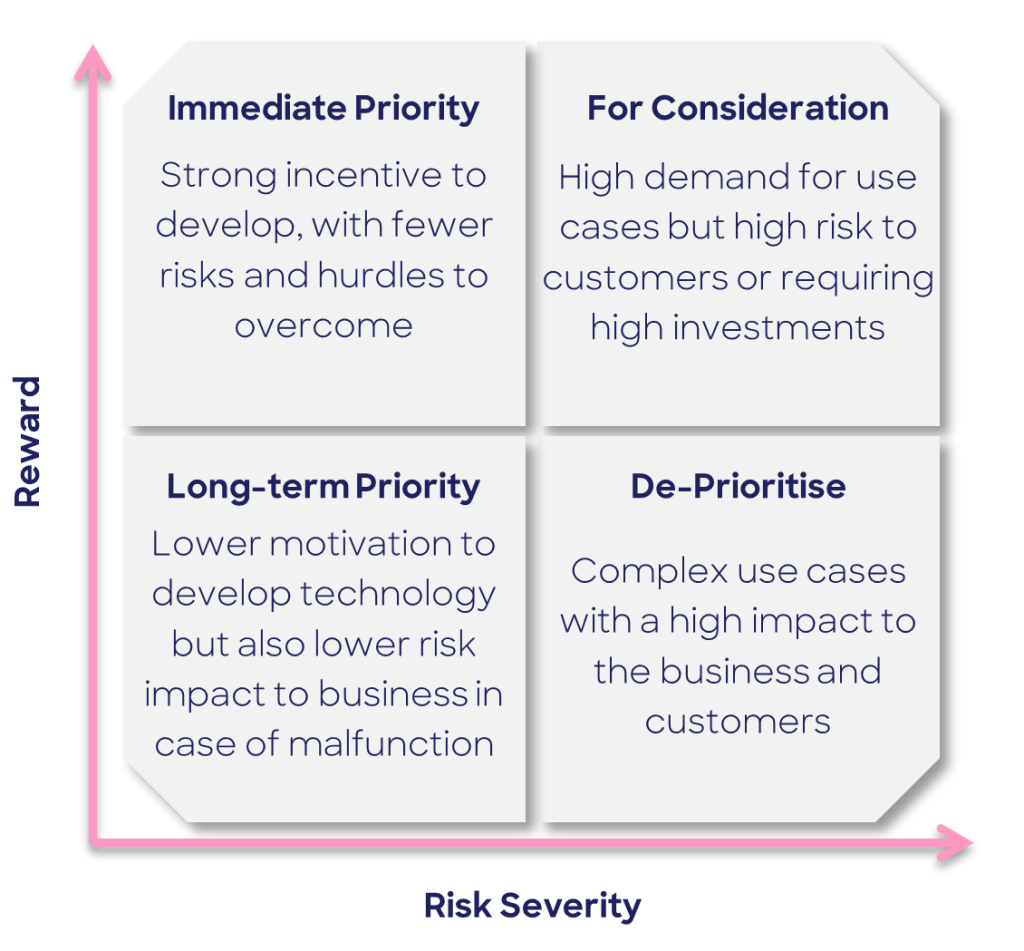

With the data foundations laid, your organisation can commence exploring use cases to understand where AI would deliver value. Prioritise those in alignment with your organisation’s strategy and available resources for investment, measuring the value and effort associated with each case. For example, the most applicable use cases may focus on increasing revenue through targeted marketing, enabled by AI-powered customer analysis. Alternatively, the organisation may want to focus on increasing efficiency, to allow for scale without increasing overheads, through agentic AI in conducting validation checks.

Your use case should be a proof-of-concept, and test your readiness across:

- Guardrails and risk controls

- Data processes and quality

- Data literacy and technical training

- Scaling AI with a defined strategy

When it comes to measuring value and effort, the following matrix can be used as a simple framework to get you thinking:

A Roadmap to AI-Ready Data

To assess your firm’s readiness for AI, with respect to data foundations, follow these steps.

- Assess your data maturity: Conduct a full audit of quality, access, and governance. Understanding where you are today will determine where you need to prioritise efforts.

- Break down data silos: Centralise data and remove legacy bottlenecks. Ensure data is stored accurately and is easy to access with appropriate security measures.

- Implement robust governance: Assign roles, develop documentation, and establish processes around data management.

- Invest in data literacy: Upskill teams and embed data culture across the business. Education around data & AI will be critical to managing regulatory and operational risks.

- Pilot with purpose: Choose a use case where clean, governed data can show fast value. From there, you can move forward to new use cases and eventually scale across the firm.

Implementing AI is an organisational transformation, beyond a technical challenge, spanning data culture, strategy and capability. By getting the data foundations right now, your organisation will be well-positioned to scale AI confidently, responsibly, and with tangible impact on for both employees and customers.

References

[1] Shumailov, I. et al. (2024) AI models collapse when trained on recursively generated data, Nature News. Available at: https://www.nature.com/articles/s41586-024-07566-y (Accessed: 21 July 2025).

[2] Artificial Intelligence in UK financial services – 2024 (2025) Bank of England. Available at: https://www.bankofengland.co.uk/report/2024/artificial-intelligence-in-uk-financial-services-2024 (Accessed: 21 July 2025).