Financial services firms of all sizes wrestle with a common challenge: how to modernise operations whilst maintaining a connection with customers? In recent years, Artificial Intelligence has moved from being an industry buzzword to presenting a real opportunity to modernise, but for some, it’s seen as a greater threat to achieving this balance. Growing maturity of LLMs, innovative new use cases, and more accessible, low-code tools, have all shifted the conversation to the point where AI is no longer just a hypothetical, even for smaller organisations. It is now a viable and transformational opportunity. By the end of 2024, more than 75% of UK financial services firms were already using AI.

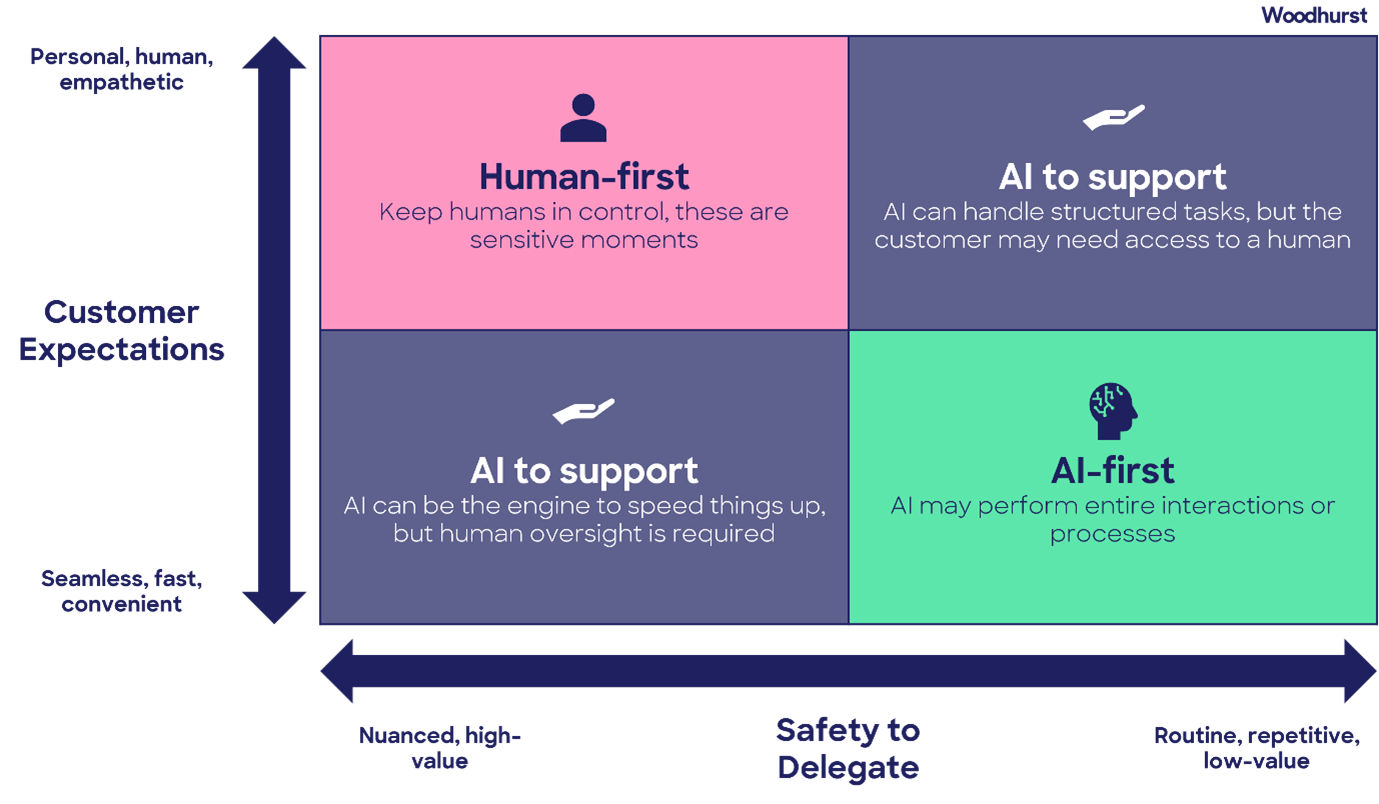

However, with that opportunity comes a critical decision: how much should you delegate to AI? Some firms will take an ‘AI-first’ route, allowing the technology to lead customer interactions or make autonomous decisions with minimal human intervention. Others will take a ‘human-first’ route, using AI to support, but not replace, the people delivering their service. Neither approach is inherently better. What matters is alignment: to your customer needs, to your brand, and to the experience you want your proposition to deliver.

The Human vs AI Trade-off

The pace of recent AI innovation means that the technology can now perform tasks that previously required human intelligence. One of the biggest challenges facing firms in adopting AI is likely to be how far do they wish to push the technology in balancing the economic upside of lower costs (assumed) with delegating decisions and even key interactions to a machine?

This is where proposition plays a key role. Organisations must start with this at the heart of any decision making to balance how far is ‘far enough’ and utilise the technology in a way that makes sense for their specific market and customer needs. For example, in a Bank that prides itself on face-to-face availability and the offer of always being able to speak with a human when required, AI can perform all the manual tasks that currently take colleagues hours per week, freeing them up to spend more time directly with customers. For a Fintech who market themselves as tech led, quick decisions, easy digital engagements, AI can now perform the role of direct contact with customers as well as the behind-the-scenes work.

Soon, with AI playing a greater role across multiple teams and use cases, understanding your customers, their needs, and preferences, will be even more important. Customers will naturally gravitate to the model that fits them best, making it essential to design your AI strategy with the customer at the centre, without getting distracted by potential cost savings alone.

A framework for finding your approach

The right approach to bringing in AI will vary between firms, and depends on multiple factors including your proposition, customer expectations, and risk appetite. To guide that thinking, firms should ask themselves:

1. What is the core promise of your proposition?

Start with what your brand stands for and your understanding of your customers’ service expectations. If your brand is built around speed, convenience, and frictionless processes, a more AI-first approach might be best-suited. Conversely, if your strength lies in personal relationships and empathy, AI may be best-positioned in a supporting capacity, working behind the scenes to free up humans for the moments that matter. Use insight and feedback to determine which interactions can be automated without eroding trust or care.

2. Where do your people add the most value?

Identify the points in your customer and broker journeys where human input genuinely improves outcomes. This could be detecting nuance in a customer’s tone, offering flexibility in a complex decision, or showing real empathy in a complaint. AI can support these moments in the background with a human retaining the key moments of value along the way.

3. Where could AI add the most value?

Conversely, think about which processes are routine, repetitive, or rules-based. For example, could AI triage inquiries, summarise documents, or provide basic product guidance in a way that is more efficient than a human? AI is more than just automation, it’s power lies in making decisions and conclusions based on the data it can access. Identifying areas where these decisions can be delegated to the AI without compromising your proposition or risk appetite is a critical step here.

4. How should my risk appetite and tech policies evolve?

Starting with your risk appetite and building new policies and frameworks to act as guardrails for the safe implementation of AI is an essential first step. Continued QA and oversight activity will be vital to ensure the AI continues to perform as you expect. With a technology that has the ability to learn and adapt, setting very clear boundaries and prompts for it’s activity will become a key organisational skill.

Final thoughts

AI has moved from hypothetical to practical at such a pace that the question is no longer whether to adopt it into your organisation – it’s how. Firms need to make the foundational decisions around AI early, and the decision addressed here is the most critical. Rely too heavily on automation without clear purpose, and you may lose the trust your proposition is built on. Move too slowly or under-utilise AI, and you risk being left behind by competitors. Get this right, and you will create an environment where staff feel empowered and can deliver faster, smarter experiences that strengthen your proposition.

There is no one-size-fits-all model. An AI-first approach may suit a digital-native lender aiming for instant decisions, whilst a human-first model may better serve a building society or bank rooted in longstanding personal relationships. What matters most is that your AI strategy grows from your firm’s goals, values and strengths. A proposition-led approach, building out uses cases whilst keeping the customer need at the very centre of decision-making, is likely the best route to a successful adoption of what is a very real, and exciting, new technology.

Written by:

David Holton, Chief Transformation Officer, Cambridge & Counties Bank

Jake Connor, Management Consultant, Woodhurst

If you want to talk more about how to use AI appropriately for your business, contact Woodhurst’s data team at data@woodhurst.com