Account Opening: First impressions count

Opening a bank account used to require a trip down to your local branch, where you would speak to a member of staff and prove your identity and address with a mountain of paper documents. But as the banking landscape has been undergoing substantial digital transformation, so too has the application process.

Consumers now want to be able to open accounts at their convenience — whenever, wherever, and without having to visit a bank branch during operating hours.

Digital account opening seems like an obvious and necessary option banks should provide. However, their good intentions to digitise in this space often isn’t met with complete success and tends to fall short on meeting customer expectations.

It came as no surprise therefore that in a survey conducted by Woodhurst, business leaders revealed that digital Account Opening capabilities are one of the key areas requiring improvement across the organisation.

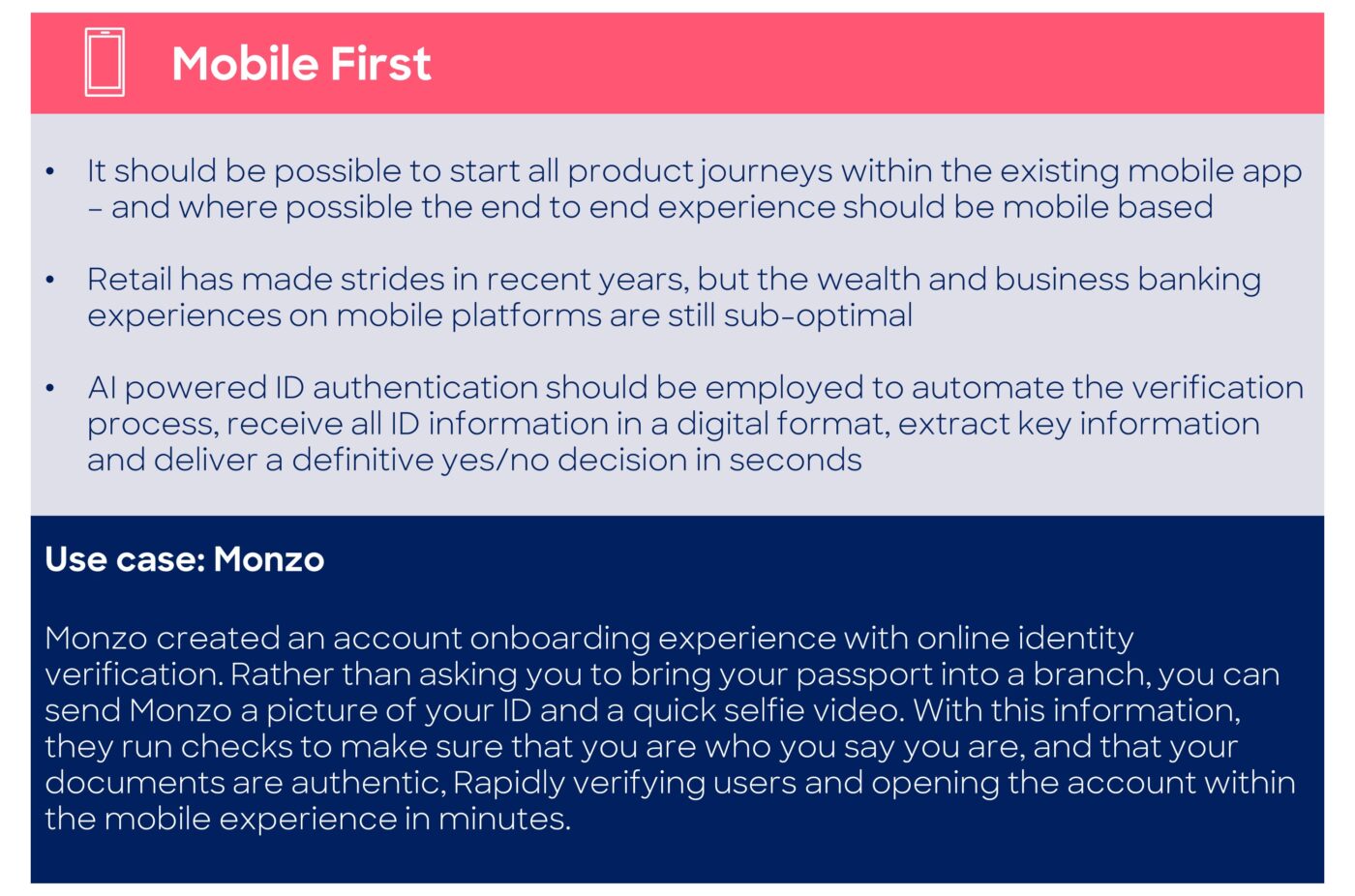

Account opening needs to be: 1- Mobile first, 2- Streamlined and 3 – Consistent and Integrated

Convenience results in conversions and customers

Customers’ expectations are rising rapidly and a truly seamless digital experience across financial services is a must. That’s why long forms and complex account opening procedures need to become a thing of the past.

Above all, banks have to ensure the whole journey is 100% digital and that the steps to open an account are clear, concise and clever. This best in class digital and customer experience needs to continue long after clients activate their profile and evolve with the ever-changing customer needs and expectations.