Fintechs: Leading the pack to define the new normal

We are in the midst of a health, societal and economic crisis, the scale of which hasn’t been seen for generations – if ever.

In this environment, Financial Services will be seen as a pillar of recovery by governments, organisations and individuals.

The crisis has undoubtedly accelerated the need for digital transformation, presenting Fintechs with an opportunity to use their unique position as digital leaders to define the new normal. Their agile models and technical expertise give them the flexibility to meet the changing needs of their customers, whilst maintaining the highest quality experience.

In order to capitalise on the opportunities for which they are uniquely placed, as well as combat the challenges that they will inevitably face, in the coming 12-18 months Fintechs should look to:

- Address the most pressing customer needs

- Collaborate to enhance capabilities across the industry

- Refocus the business model

1. Address the most pressing customer needs

The crisis is causing widespread concern and economic hardship for consumers, businesses and communities across the globe. Now, more than ever, Fintechs need to act to address the needs of their most impacted customers – individuals and SMEs.

Broadly, these customer groups share two immediate needs:

- Increased access to funds

- Support navigating out of the crisis

Increased access to funds

Since the crisis began:

- Around 2.8m people have applied for Universal Credit

- 9.1m have used government furlough schemes

- Over £12bn has been distributed in CBILs

- Over £32bn has been distributed in bounceback loans

In a world that we hope will be increasingly driven by Open Banking and Open Finance initiatives, Fintechs can use their intelligent analytical tools and rapid payment rails to get funds into the hands of the right customers, at the right time.

Clearly the narrow transactional history that incumbent credit tend to assess will have been skewed since March, opening up an opportunity for Fintechs to assess a more holistic and thorough data set.

For individuals, this could lead to more accurate affordability assessments – extending credit to a wider pool. Over time, predictive analysis can identify when individuals will be in need of rapid funds, offering fairly priced, personalised credit lines before the customer is adversely impacted.

For businesses, much of the same is true. Predictive models can identify when short term credit facilities might be needed, and to what level, dramatically reducing the lead time to securing required funding.

There’s also significant scope for innovation within asset and invoice financing. For example, Barclays has recently partnered with MarketInvoice – Europe’s largest online invoice financing platform – to offer digital invoice finance. Partnerships like this will be a recurring theme in the post-COVID world.

Support navigating out of the crisis

The same expanse of data and intelligent analysis that is used to predict credit requirements can also be used to provide wider insights on how businesses and individuals can navigate out of the crisis.

Personal Financial Management tools have been improving over time, but their use isn’t as widespread as it could be. Nudges, tips and advice about balances, upcoming payments and spending patterns can help customers change their behaviour and improve their financial situation over time.

Open Banking has enabled this level of insight for payment accounts; Open Finance will broaden the potential analysis across a customer’s entire financial estate.

Conversely, SMEs and businesses have limited access to high quality, insightful products. Fintechs could use the available data to provide much needed cash flow and working capital analysis – pre-empting the signs of upcoming financial distress. Put simply, by intelligently using data and providing a seamless, digital customer experience, Fintechs are well-placed to provide their retail and business customers with access to much needed funding and the insights that can help them to navigate out of the crisis.

2. Collaborate to ehance capabilities across the industry

Through strategic partnerships and complementary specialisms, Fintechs have helped to shape enhanced digital experiences that provide market leading products and services to the right businesses and individuals, at the right time. In recent years the value of these partnerships has been realised with a plethora of success stories, including:

- Tandem Bank and Stripe partnering to deliver a new autosave feature

- Marcus – Goldman Sach’s digital bank – partnering with Saga to offer savings accounts

- JPMorgan Chase and Plaid partnering to help customers to control personal data

Conversely, the short-lived experiences of would-be digital banks Bo (RBS) and B (CYBG) highlight the downfalls of an insular approach to product development.

These partnerships must be built upon:

- Strong alignment in a strategic goal

- Established common ground and value drivers

- Commitments to building and scaling the joint venture

- Shared success metrics for the partnership

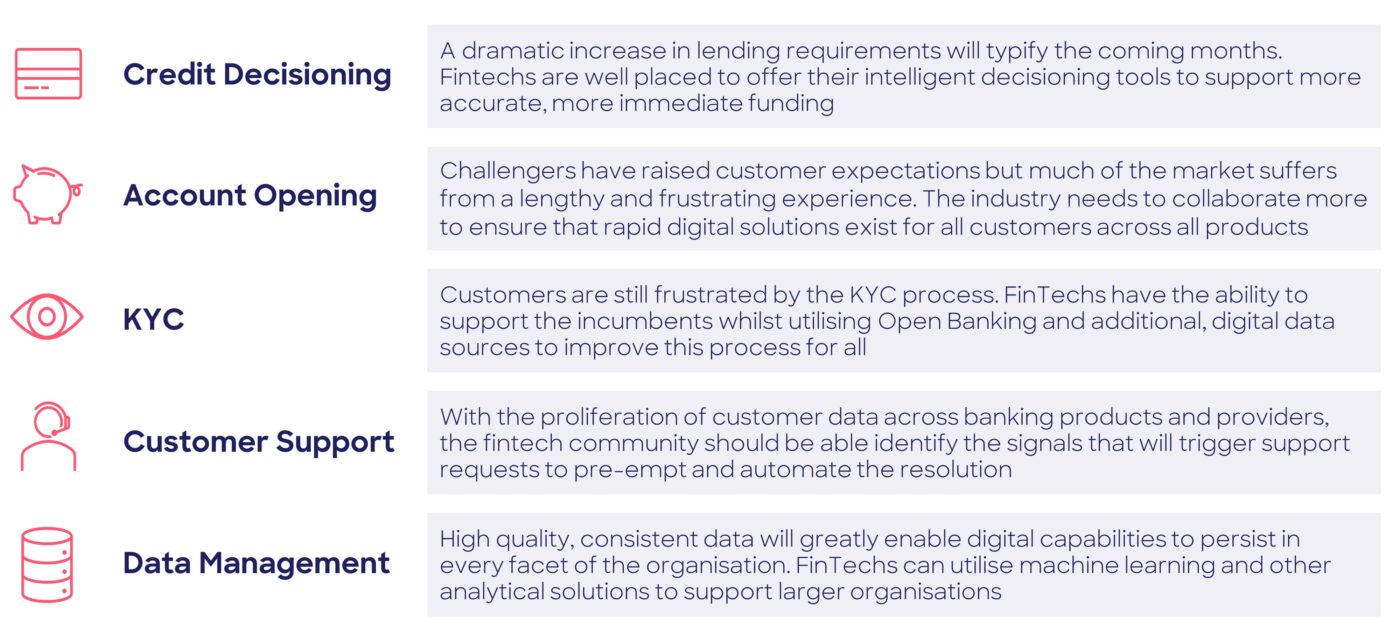

Fintechs can particularly focus on areas where customer needs are underserved by incumbents. In a recent study of senior leaders in the industry, Woodhurst identified five core capabilities that are in immediate need of enhancement.

The future is collaborative; the opportunities that deliver great value to customers will win confidence and market attention.

3. Refocus the business model

Fintechs would appear to be in a stronger position to flourish in the post crisis world as they can adapt to the changing landscape and harness advanced digital capabilities.

However, with central banks setting interest rates at historic lows and a global recession looming, venture capital is growing far more selective about which Fintechs get funded, and some may be critically impacted.

Therefore, Fintechs need to identify a way to shorten the timeframe to profitability.

Now is the time to reflect on internal business models to ensure operations and growth can continue at the optimum rate, without compromising on the service or core vision.

Diversify vs Double Down

This dichotomy is a perennial challenge for Fintechs, but one that sharpens into focus during hard times. Unfortunately, there is no one size fits all approach.

N26’s exit from the UK – largely due to political and economic uncertainty, coupled with a crowded marketplace – is an example of a firm doubling down on a focused proposition within priority markets.

In other cases, this will mean diversifying product lines or markets to identify new revenue streams and build a more robust business. For example, Starling’s expansion into the SME market brought an immediately profitable client base and taps into an underserved segment.

Crucially, they say that necessity is the mother of invention, and this will be more prevalent now than ever. How Fintechs quickly provide support and solutions to meet new challenges that customers face will be their legacy in the years to come

Don’t compromise on the experience

With COVID-19 pushing everyone towards digital channels, demand for Fintech’s more seamless digital customer experiences will likely increase.

Fintechs need to ensure that increased demand doesn’t come at the expense of the very thing drawing people in, the exceptional customer support and end to end experience.

Ongoing interaction with customers to understand their evolving needs and expectations will be critical, focus more on product engineering and find innovative ways to deliver a seamless customer experience in order to grow along with the customer base and expectations.

Fintechs to leads us into the future

In an environment that will be typified by uncertainty and economic difficulty, the Financial Services industry could be a shining light in the recovery by leading with digital solutions to complex, human challenges.

What’s more, given their key strengths, namely flexibility and innovation, Fintechs are best positioned to lead this change, allowing them to not only survive the crisis but also thrive in the years to follow.

This article was featured in the latest edition of The Financial Technologist magazine – The Phoenix Edition by Harrington Starr, alongside some of the leading names in Financial Technology.

The Phoenix Edition is your Blueprint for fighting back from COVID in Financial Technology!

Download the full magazine here: The Financial Technologist: Phoenix Edition